Recommendation Info About How To Claim Daycare Income

Government programs child care financial assistance (also called vouchers, certificates, or subsidies):

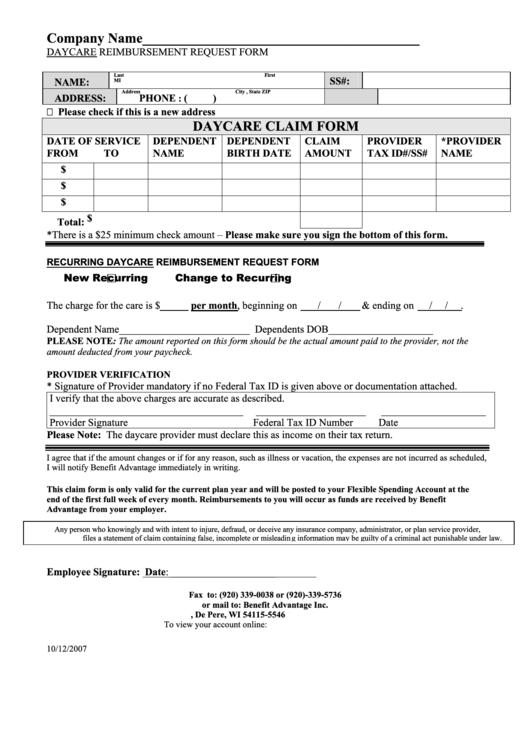

How to claim daycare income. Your new spouse's earned income for the year was $2,000. Child care expenses are amounts you or another person paid to have someone else look after an eligible child so you could earn income, go to school, or. A credit, on the other hand, reduces your total tax bill dollar for dollar.

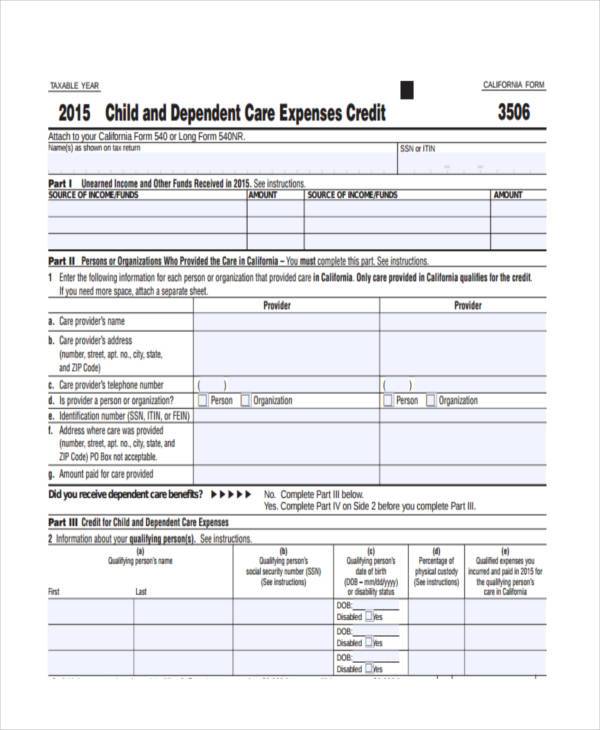

States and territories receive funding from the federal government to provide. To claim the credit, you will need to complete form 2441, child and dependent care expenses, and include the form when you file your federal income tax. The child was under 16 years of age at any time in 2023 the child had a.

Are you ready to file 2023 childcare business taxes? I get it i was scared to jump in too… i would see so many. Types of care that qualify include daycare, babysitters and nannies.

You can claim from 20% to 35% of your care expenses up to a maximum of $3,000 for one person, or $6,000 for two or more people (tax year 2023). Running a child care business has long been a very challenging math problem: Eligibility checklist to determine all of the eligibility requirements, please refer to the checklist below.

I would see so many videos with income claims, and reall. zack | faceless digital marketing on instagram: If you paid an individual to provide child. Information for persons operating a daycare in their home, including such topics as keeping records, issuing receipts, expenses, tax payments,.

русский tiếng việt you may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you (and your. You can claim a deduction for medical and dental expenses greater than 7.5% of your adjusted gross income if you itemize your deductions. However, special rules apply to military personnel stationed outside.

You (or your spouse if filing a joint return) lived in the united states for more than half of the year. Generally, you can claim this credit if you pay for childcare for a kid under 13. Calculate your gross and net income ( loss) on a fiscal year basis using the.

Lewis has one child and earned $26,000 in 202 3.ms. By claire cain miller. Lewis spent $3,000 during the year on child care.she owes $ 520 in federal income tax.

Calculate your allowable deduction. Fill out part a and part b of form t778, child care expenses deduction. Find out the important tax information all providers need to know as the filing deadline approaches.

So, a $1,000 tax credit will shave $1,000 off your tax bill, regardless of your tax bracket.