Who Else Wants Tips About How To Start Charitable Trust

6,049 4 mins read if you want to form a charitable trust but are confused about how to do so, don't worry.

How to start charitable trust. Before registering your trust, you must make the following decisions: To incorporate a charitable trust board you must submit an application, along with the required documents. The starting income and balance levels for each reflect the median values recorded in federal datasets, expressed in 2023 dollars.

In this article, we'll explain everything you need to know. Draw up a trust document. > name of the trust > address of the trust > objects of the trust (charitable or religious.

Father and son cheered by supporters as they begin charity trek from molineux. At the state level, the attorney general's office typically oversees charitable trusts. Generally, there are a couple of steps for creating a charitable trust:.

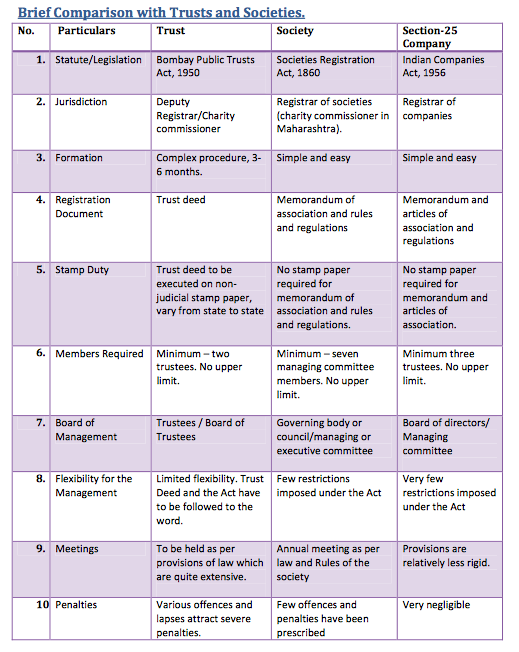

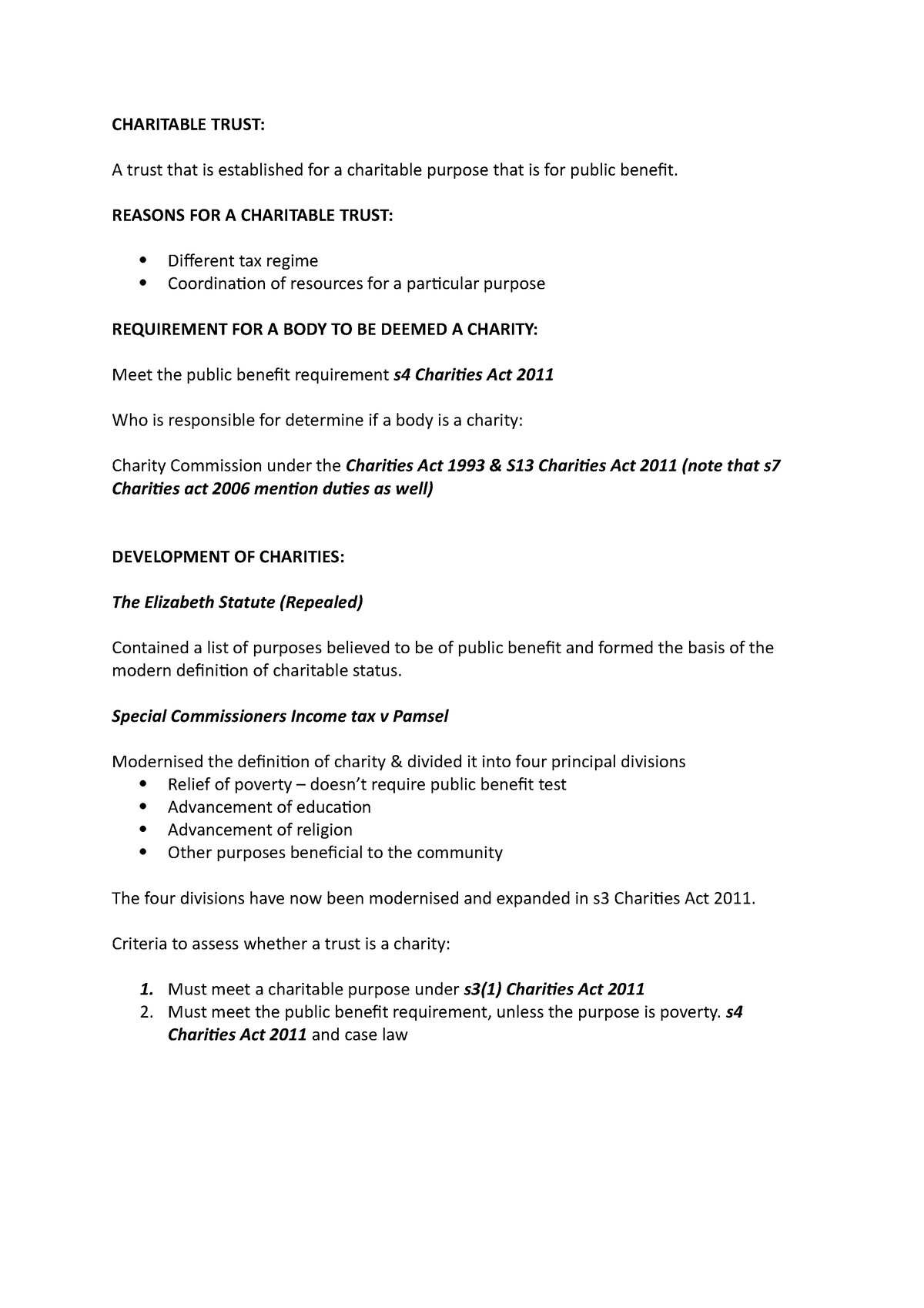

There are four categories set out in the charities act. There are two basic types of us charitable trusts:. Learn how to register a charitable trust in india.

The beneficiary the trust property or the subject matter of the trust the objects of the trust as per section 6 of the the indian trusts act, 1882 a trust is. In maharashtra and gujarat trust is registered in charity commissioner office who has jurisdiction over the trust office. Contact the office of your state's attorney general.

Know the procedure to create a public charitable trust and about form 10a and 10g. To register your trust you need to follow the steps. It was an early start for a dynamic duo as they set off.

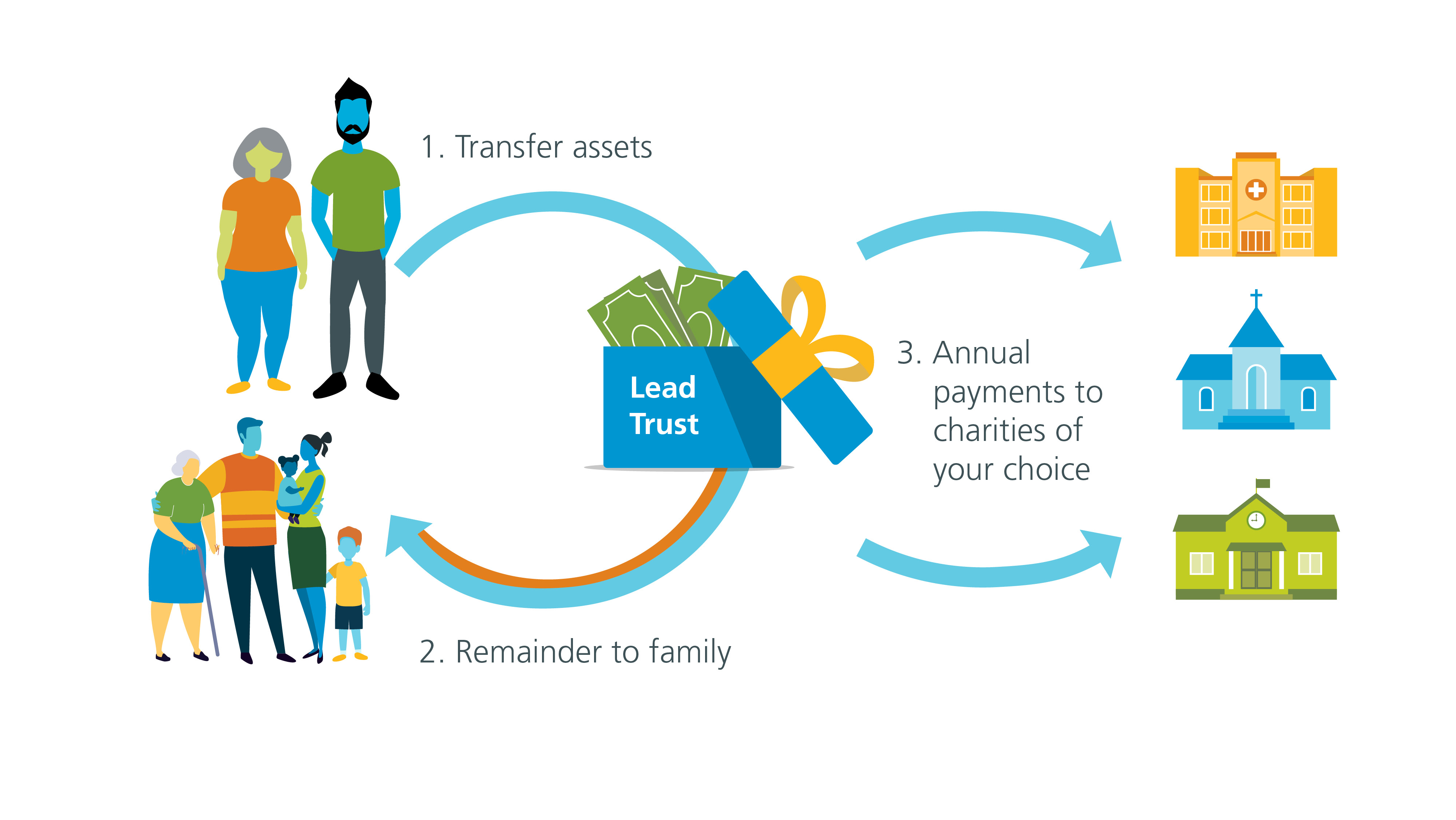

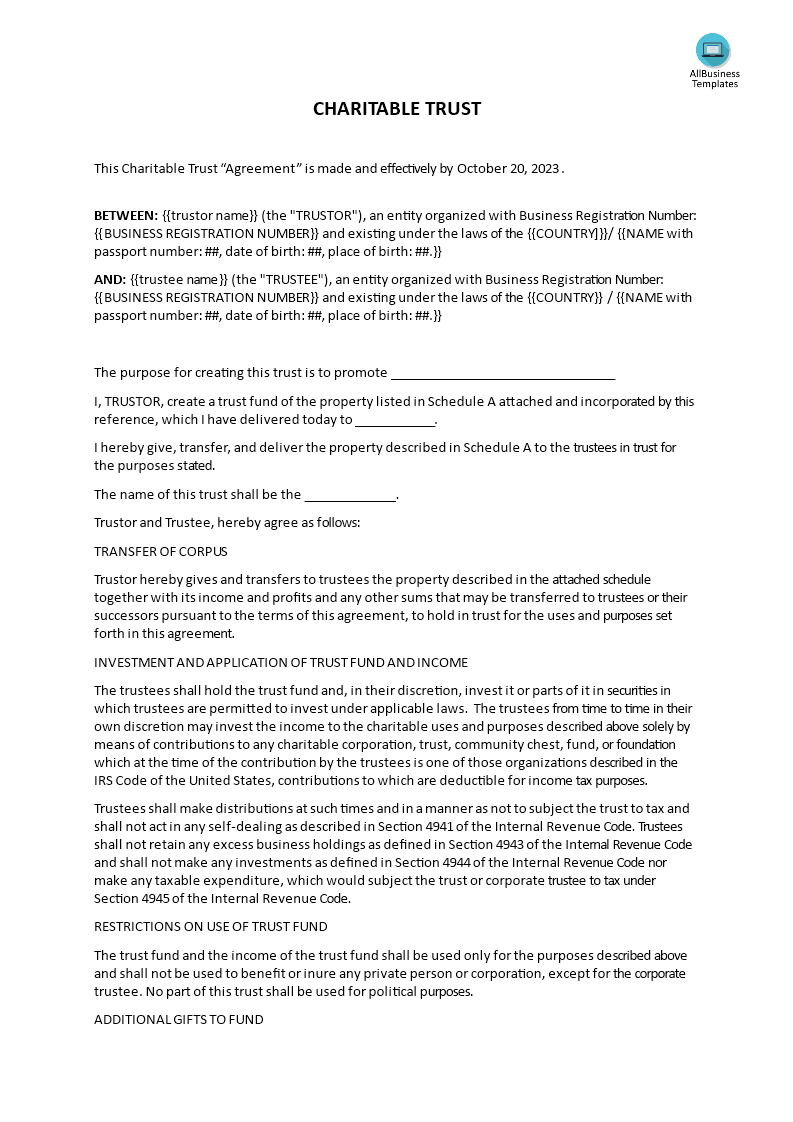

Local news you can trust. The charitable trust is created through a trust deed. Identify the trustee and beneficiaries 4.

It will explain how members. A survey conducted for the. This is the document that governs the way in which the trust is run.

There is no registration fee. Determine the purpose of creating the trust 2. How to create a charitable trust.

An estate planning attorney can help you, as can some financial advisors. Upon creating and funding a crut, john and mary will first bypass a capital gain of $225,000 on the sale of the appreciated land, saving $53,500 (20% capital gains. On the website for the.