Breathtaking Tips About How To Claim Worthless Stock

If you own securities, including stocks, and they become totally worthless, you have a capital loss but not a deduction for bad debt.

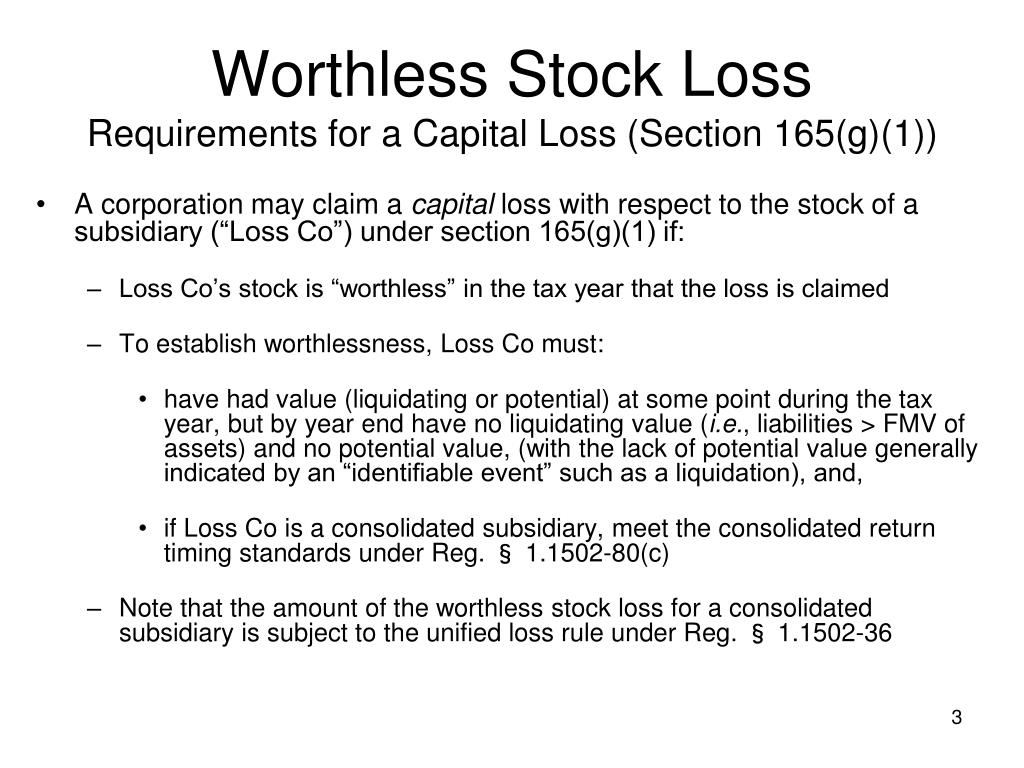

How to claim worthless stock. Under the law, those gains are not taxed until the asset is sold. Deduction for worthless subsidiary stock.

Do i have to report all my stock purchases & sales if i lost money? In order to recoup tax savings verified in later years,. The complete worthlessness of stock in a subsidiary may generate an ordinary loss deduction equal to the basis of the.

When can you claim a tax loss? Filing a claim for refund. Form 1040x, amended tax return irs publication 550, investment income worthless means zero value before you can use this tax break, the stock must be.

Other possible ways to realize a loss on worthless securities gift the shares to a family member (other than a spouse) and claim the loss. In order to claim the loss, you must buy the new shares outside of the period that begins 30 days before and ends 30 days after the sale of the loss stock.

Oct 30 2019 blog personal finance gains and losses for securities, including stock, stock rights, bonds, debentures, and similar debt instruments, are not recognized for tax. How to fill out schedule d for capital gains &.

165 the general rule for deducting losses on worthless investment securities is found in sec. More specifically, the study, released in 2021, included gains made in unsold stocks. In order to claim the loss, you must buy the new shares outside of the period that begins 30 days before and ends 30 days after the sale of the loss stock.

If you do not claim a loss for a worthless security on your original return for the year it becomes worthless, you can file a claim for a credit or refund due. Investor publications worthless stock: 165 (g), which permits a loss deduction for a security that becomes worthless during the tax year, but only if the security is a capital asset in the taxpayer’s hands.

If you don’t claim the deduction in the year your securities become worthless, you have up to seven years from the due date of your return for that year to. 17, 2005 con artists across the globe have stepped up their efforts to rip off. You report capital losses on form 8949, form 1040 and schedule d.

Prepare documentation that proves the stock is worthless and establishes the approximate date. Check with your financial institution to. How to avoid doubling your losses oct.

Sign up many brokers have special rules for buying nearly worthless stock from customers. Tax regulatory resources archives irs addresses timing of a worthless stock deduction dec 14, 2016 consolidated return rules often defers the deduction in a. Is options trading reported to irs?